Check out this article highlighting the top rental markets. Close to half of these cities are in Florida. That’s right–8 out of 20. If you’re still not buying down here, there’s time. But not for long. . .

While buying single family rental properties has become the darling investment strategy of Wall Street, it may not always make sense for individual real estate investors — particularly in some markets already picked over by the large institutional investors. But there are still markets where the numbers work for the conservative, individual investor looking to purchase foreclosures and other homes as single family rentals.

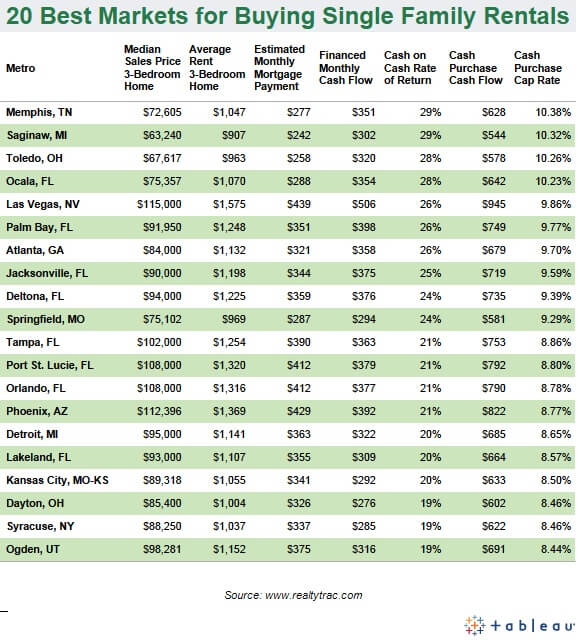

RealtyTrac developed a list of the 20 best markets nationwide for purchasing single family rentals by analyzing median sales prices and average rental rates for 3-bedroom homes and using that data to calculate capitalization “cap” rates and average cash flows.

20 Best Markets for Real Estate Investors To Buy Rentals

Here is a great reference chart for Real Estate Investors to use to help them find good investment deals.

Calculating cash flow and cap rates

Cash flow is simply the difference between the income produced by the property in the form of monthly rent and the costs associated with the property: mortgage payment, property taxes, insurance, repairs, etc. Positive cash flow is always the goal, and negative cash flow is best avoided. The cap rate is the percentage that the net annual income produced by the property (monthly cash flow multiplied by 12) represents of the original purchase price paid for the property.

For example a home purchased for $100,000 that generates $500 in positive net cash flow each month would have a 6 percent cap rate ($500 multiplied by 12 is $6000, which is then divided into the original $100,000 purchase price).

To calculate cap rate and cash flow, we assumed a 20 percent down payment and a 4 percent interest rate to come up with an estimated monthly mortgage payment. Based on feedback from real estate investors we subtracted an additional 40 percent out of the gross monthly rental proceeds for property taxes, insurance and repairs.

“The bottom line is, the best rental property for an individual to buy is the one he or she both understands best and is able to manage most efficiently and effectively,” he said. “The rest is basically just conversation.”

We love your feedback and welcome your comments.

Please post below: