A common question I am asked by students is whether or not it is possible to flip HUD properties. The answer is yes, you can flip HUD Homes. But there are a few things you need to be aware of with HUD properties.

Tips For Working on HUD Deals

Exclusive Lisiting Period

Since HUD is a government entity they would rather have owner occupants buy their homes than investors. For this reason they have a 15 day window called the “Exclusive Listing Period” which prohibits investors from bidding on properties. During this 15 day period only Government Entities, Non-Profits, and owner occupants can bid on properties on the HUD website.

Since HUD is a government entity they would rather have owner occupants buy their homes than investors. For this reason they have a 15 day window called the “Exclusive Listing Period” which prohibits investors from bidding on properties. During this 15 day period only Government Entities, Non-Profits, and owner occupants can bid on properties on the HUD website.

Once the Exclusive Listing Period is over, then bidding opens up to all bidders (including investors).

HUD Registered Bidders/Agents

The second thing to know with HUD properties is that you need a HUD Registered Agent to submit the bid on your behalf. HUD calls these “HUD Registered Bidders”. Not all real estate agents are registered bidders with HUD. Find one that is.

Accepted Offers & Deposit Requirements

If HUD accepts an offer on your behalf that is placed by your agent, then HUD requires a a contract signed by you from the agent that placed the bid on the property. The signature on the contract needs to be an original “blue ink” signature (no copies, scans or docusigns allowed). In addition to a signed contract, HUD also requires a deposit. This deposit needs to be in the form of a cashiers check and needs to be payable to HUD (or their local entity like Pemco).

One thing that is important to note is that deposits on HUD properties are NOT refundable. So it is a very good idea for you to inspect the property and make sure that your comps and the condition of the property make sense for you when putting up the deposit. You will not be getting your deposit back if you do not move forward. And your agent might be blackballed. So it is a good idea to close on anything you bid on.

No Title Seasoning

If you purchase the property then after you have purchased the property you are able to flip it, fix it or rent it without any deed restrictions whatsoever. HUD does not really care what you do with the property once you have paid for it. You will have to have a way to pay for the property though.

HUD Bidding Tactics

Many students ask what percentage of listing price they would need to bid in order to have their offer accepted. This varies from State to State and City to City. Generally speaking cities that have higher demand for properties are going to demand higher prices and have more bidders (and vice versa). So if the property is in a rural area with low priced properties there may not be many bidders and you may be able to get the property for substantially less than asking price. However in an area with many investors bidding can go at or even above asking price.

The length of time that the property has been listed is very important too. If the property has been listed for 90 days or longer HUD will be much more likely to accept a lower offer than if the property was just recently listed.

Many online sources (including HUD’s website) seem to indicate that bids above 85% have a fair chance of being accepted. I don’t find this to be true. What I find is that if you bid less than 85% of asking price you will most likely have your offer automatically rejected.

There is no minimum bid, but in our experience your bid should be close to, or in line with what other cash investors would pay for a similar property. In many cases you will simply be outbid if you offer too little (which is exactly how HUD wants it to be).

HUD Closing Costs & Commissions

HUD will pay your closing costs which can be up to 3% of the purchase price. HUD also pays the bidding agent a 3% commission. So HUD would net whatever your bid amount is less the 6% for commission and closing costs and the listing agents commission. Keep in mind that for purposes of bidding the 85% of listing price is a net number (meaning net to HUD after commissions and closing costs).

Finding & Flipping HUD Homes

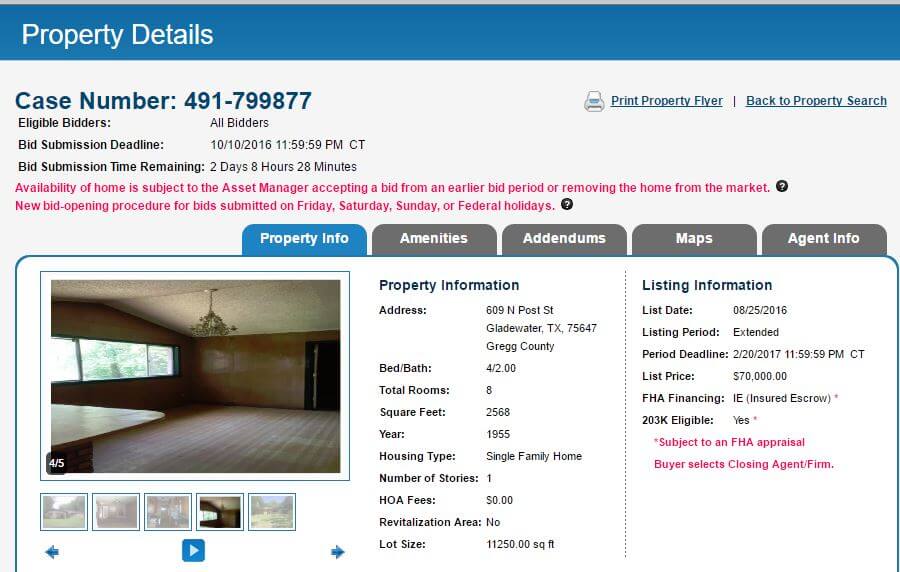

Where do you find HUD Homes? Visit their website www.hudhomestore.com

So can you flip HUD Homes? Absolutely. All you need to do is find yourself an agent that is a registered bidder and start placing bids. If you don’t have a real estate agent that is a Registered HUD Bidder then you can find one on the site above by clicking on “Find a Broker”.

Many HUD properties make great rentals. And if you are patient you might find an amazing deal. There is not a lot of inventory, but occasionally very good deals pop up. So make sure you visit their site often and grab of of these HUD Homes before someone else does.

Good luck with your bidding on HUD Homes. I hope the next home you find is that perfect fix and flip or rental property investment.

We love your feedback and welcome your comments.

Please post below: