Introduction

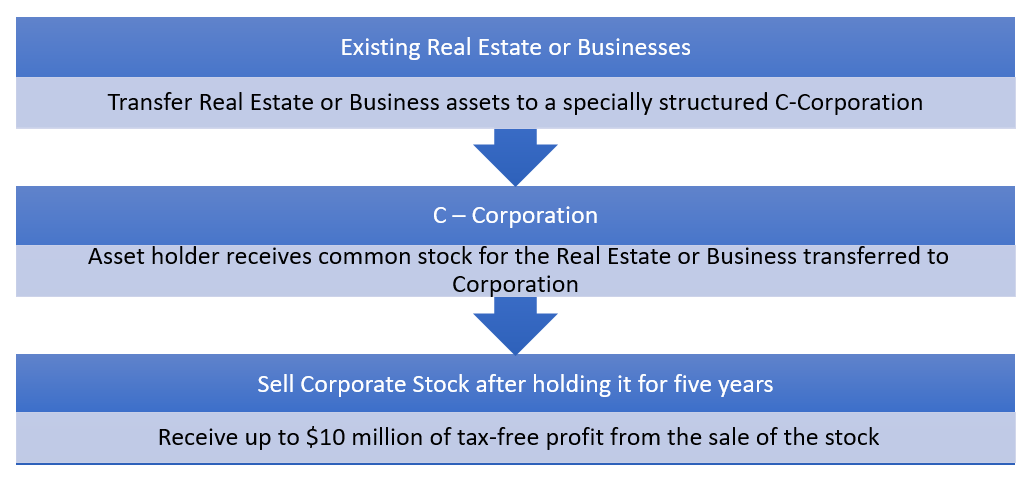

Did you know that there is a way to convert real estate or business holdings (profits) into tax-free income? The process is fully approved by the IRS under IRC 351 and 1202 and available to anyone but is only known to a few on how to structure the transaction. It involves utilizing various IRS code sections to structure the transactions and then over a period of five years scrutinizing business operations to make sure that all of the IRS rules are followed to permit the tax-free sale. When the specific tax structuring and monitoring is employed it can produce up to $10 million or more of tax-free gain at the end of five years.

Real Estate Or Business Assets Can Be Utilized

This process would permit any type of real estate to be utilized and it would permit virtually any type of business entity also to be converted over into the C Corporation. The property is transferred to the C Corporation in exchange for newly issued common stock of the C Corporation.

The C Corporation Stock

The corporate stock must meet Qualified Small Business Stock (QSBS) rules. After six months of initially holding the corporate stock it can be sold and transferred into another corporation’s stock to continue the five-year holding period within a 60-day window. There are certain requirements for the C Corporation as to the assets it can and cannot hold and for the businesses that it can and cannot participate in and operate. This must be monitored by a knowledgeable party to make sure that over the five years the stock will qualify as (QSBS) for a tax-free sale.

The Tax-Free Sale

Once the five-year holding period has elapsed, the stock may be sold to any party. The total amount of profit that may qualify as QSBS tax-free stock profits would be up to $10 million or 10 times the stock basis, whichever is greater. This must be reported on a tax return and there are provisions in both federal and state (depending upon the individuals state) tax laws for excluding this income from taxation. There would be no capital gains tax or ordinary income tax assessed on these profits.

Conclusion

By far and away, this is the best procedure for converting existing assets that will be sold at some point in the future, given a five-year sales window, to obtain tax-free profits. It will also permit during that five-year period that the assets can be invested in say a company that is growing. For example, those profits when transferred into a company may only be valued at $1 million at the time of transfer, but if the company is able to grow the asset value into $10 million over that five-year period, then this whole amount can be sheltered from taxation. The main function is to plan ahead over a five-year period rather than selling an asset immediately which would subject it to capital gains. Tax planning in this case can save millions of dollars in taxes, this is why tax planning is so important.

We love your feedback and welcome your comments.

Please post below: