Hey, guys, Sperber here, back in action. So we recently kicked off this series with the First Steps to Owning Cash Flow Real Estate and today we're jumping back in the saddle by going over various types of cash-flow rentals.

Hey, guys, Sperber here, back in action. So we recently kicked off this series with the First Steps to Owning Cash Flow Real Estate and today we're jumping back in the saddle by going over various types of cash-flow rentals.

We have lots of good stuff to cover so let's get going…

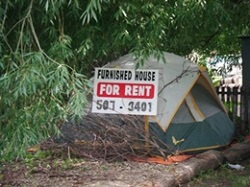

#1 Single Family Homes

By far, the favorite and most traditional rental property is the single-family home. They're the best, in my opinion, as far as long-term investments go. They're obviously easier to manage and maintain.

They have the highest demand from both from renters and investors. Investors will buy them and homeowners will buy them as well. But when we're talking about rental purposes (when you can have someone paying your mortgage on a single-family home while it's appreciating and your principal is being paid down if you have a loan on it), then you're looking at profits across the board…

Profit now, profit later – that's true wealth building.

The one problem with single-family homes is if it's vacant, nobody's helping you pay the mortgage.

Which leads us to…

#2 Duplexes

This is a good starting point for investing in multi-unit buildings. I love duplexes. Duplexes bought in the right area will appreciate a lot like single-family homes and, the good news is, if one side's vacant, at least the other side's helping you pay the mortgage.

#3 Multi-Units

Let's talk a little bit about multi-units (up to eight units). Once you move out of duplexes, you start getting into things like four-plexes.

But now, you're talking about a different type of tenant.

With a duplex, it's more like a single-family home. Investors will buy them and they'll rent them out or you'll be able to resell them down the road to either the investor or the homeowners, so your exit is much simpler. There's a lot more flexibility for your exit with single-family homes and duplexes, whereas when you get to three or four units, your exit's going to be different.

People who are going to buy a four-plex from you are really, truly only buying them for the return on the monthly – the residual. Their yield. Anything four-plexes and below is considered residential in the lending world. Anything above four units (so five units and above) is considered commercial.

It's probably going to be a lot easier to get a loan on something four doors and below because there are more lending prospect options. On the reverse of that, too, you will start to see that investors who are selling five units and above are usually open to more creativity when it comes to owner carrying and things of that nature.

Keep in mind the different types of people who are going to live in these units. When you start to get into four units and above, you're going to be dealing with more transient-type people. You're going to deal with the younger crowd, who might move in and move out in the middle of the night and not pay you.

So now, the need for property management is going to be somuch more important than it was for those single-family homes you rent out.

I can't tell you how many students I've talked to who will say:

“You know what, I bought three or four single-family homes. I manage them myself. It was easy. But, when I bought a four-plex. It all fell apart.”

And that brings us to…

Should You Hire a Property Manager?

Property management (in general) is going to be key. The reality is the more units you add, the more instability you have because while you can talk about the appreciation you think you're going to get, even on an appraisal, investors are going to be looking at the income approach when it comes to the value of the property.

You've got to keep in mind – it'll be all about the numbers when you start getting up into more units. Rentals are great for cash flow, but again you're talking more of a management-maintenance nightmare the more that you have.

You've got to keep in mind – it'll be all about the numbers when you start getting up into more units. Rentals are great for cash flow, but again you're talking more of a management-maintenance nightmare the more that you have.

You're going to have to start looking at on-site management (having somebody there 24 hours a day)versus just regular property management. It’s a vital decision when you start getting into the larger multi-unit type buildings.

Now, the key to this is making sure that you can afford high-quality on-site property management because you can literally make the investment totally work or totally fail, depending on management.

That's it. That's the key to your success when you get up into those larger apartment buildings. Good, quality management can literally add hundreds of thousands to your asset’s worth.

That brings us to the question:

To manage or not to manage ourselves?

It's a tough question that only the investor themselves can answer. The only way you can answer it is if you go out and do it yourself because you'll never really know how much work it is or how well you can do it until you actually do it.

The real question is this: Can it make a viable difference being your own property manager?

Well, it definitely is a job. A BIG job. But, you're talking 7%-10% a month to your gross monthly rents (7% to 10% that you'd pay out), depending on the property.

It’s well worth it to some investors but, for me personally, I don't think so. I’d rather hire a property manager and spend the time making more money instead.

From everything I've had to deal with in property management, my advice is to figure that into your costs. Even if you have no intention on buying a property and keeping it, even if you intend to buy it to fix it … always, always include property management in case your exit strategy doesn’t go as planned.

Anyways, that’s a wrap for this lesson. Next time in this awesome series, we’ll talk about how to go about finding the right property manager.

We love your feedback and welcome your comments.

Please post below: