Ever wonder what is a good credit score, and why this little three-digit number is so crucial to your financial well-being? Can it really affect your everyday life? And what kind of control do you have over it?

In a special guide to credit score ranges, Saundra Latham helps us tackle and find the answer to many of these questions asked above. Let's take a look at what your credit score means, what’s considered a good score (and what’s a bad one), how your credit score can help or hurt you, how to improve your credit score, and how to get free reports.

What Is a Credit Score?

A credit score is a single number that represents how trustworthy you are from the perspective of someone who would lend you money. If you haven’t proven yourself trustworthy, your credit score will be low; on the other hand, if you repeatedly show yourself trustworthy (by paying bills on time, every time), your credit score will be high.

Credit Score Ranges at a Glance

The two most commonly used credit scores are those issued by Fair Isaac Corp. (FICO) and VantageScore, and each uses a range of 300-850. If you recently got a peek at one of your credit scores, and you’re simply wondering whether it’s a good one or not, here’s a quick look at what’s considered an excellent, good, fair, and poor credit score, according to consumer credit expert John Ulzheimer:

Bad Credit: 300-650

“A score of 650 is generally used as the dividing line between prime and subprime,” Ulzheimer says, referring to the point at which lenders consider you a much greater risk. A score below 650 means you’ll have a harder time qualifying for loans or credit cards, and may have to pay much higher interest rates when you do.

Fair Credit: 651-700

The average American’s FICO score was 695 in 2015, an all-time high. “A score of 700 gets you to about the 50th percentile nationally,” Ulzheimer says.

Good Credit: 701-759

If your credit falls within this range, Ulzheimer says, you’re likely to get approved for whatever you’re applying for. But, he adds, “There’s no guarantee you’re going to get the best deal the lender has to offer.”

Excellent Credit: 760 and above

Ulzheimer says a score of 720 is enough to get the best published interest rates on an auto loan, but the best mortgage rates are only available to people with credit scores above 760. “So, I’d define an ‘excellent’ credit score as one that ensures the best possible deals across all lending environments, which is 760 or above,” Ulzheimer says.

Below, we’ll dig in a little deeper to understand what your credit score means, why you have several of them, how they’re calculated (and by whom), and how to improve a bad credit score.

How Your Credit Score Affects Loans

As mentioned earlier, having a good credit score can make your life easier. Now let’s take a closer look at the impact your credit score has on what loans you qualify for and how much you’ll pay. Specifically, let's examines mortgages.

Mortgages

A good credit score can make all the difference when you want to become a homeowner or use a mortgage loan to buy investment property. While loans to those with bad credit have recently been on the rise in other sectors, that’s not the case with mortgages. Lenders were burned by the subprime mortgage crisis of 2008 and have kept a lid on loans to subprime, or bad-credit, borrowers.

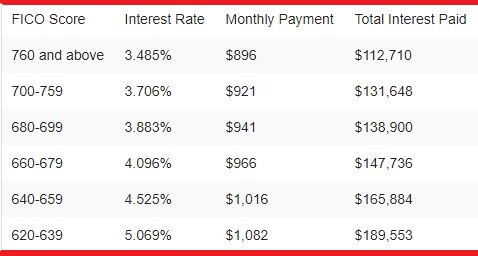

For a more concrete example, let’s say I’m applying for a fixed-rate, 30-year mortgage for $200,000 in Tennessee. Take a look at the chart below, drawn from the myFICO loan savings calculator, to see how my credit score would affect my interest rate, monthly payment, and what I ultimately pay in interest over the life of my mortgage.

As you can see, if I have a FICO score in the bottom tier of this table, I’ll be paying $186 more a month for my mortgage than someone with a score of 760 or above. I’ll also be paying almost $67,000 more in interest over the life of the loan.

Interestingly, mortgage lending has tightened so considerably that it’s difficult to get a mortgage below, or even at, the 639 mark. One exception can be the Federal Housing Administration loan program, which may make loans to borrowers with scores as low as 580.

How Do I Check My Credit Score?

Now that you’ve learned all the essentials about your credit score, let’s talk about how to check it. There are several places you can do this, but some are better than others.

Note that by law, you are entitled to a free copy of your credit report from each of the three major credit bureaus every year from AnnualCreditReport.com. Unfortunately, this report does not actually include your credit score, but it does include all the information your score is based on — what credit accounts you have, how much you owe, whether you’re paying on time, and so on.

Free credit score report sites

It’s hard to beat free, so what’s the catch? Well, some less-than-reputable sites aren’t really free at all — they come with strings attached. Often you’re signing up for an initial free service that sticks you with another monthly bill when your trial period ends.

Fortunately, there are reputable sites that do let you see your credit score for free. Note that you will not be seeing your actual FICO score, which is what most lenders see and use, and typically will only see a score based on information from one credit bureau, not all three.

- Credit Karma is partnered with TransUnion. It has a good variety of credit tools and educational information as well as fewer ads than its competitors. You will see your VantageScore based on TransUnion data.

- Credit Sesame is now also partnered with TransUnion. Their free service actually provides identity theft insurance, but paid products are pushed more, too.

- Quizzle is partnered with Equifax. It provides a full credit report every six months. You will see your VantageScore based on Equifax data.

We love your feedback and welcome your comments.

Please post below: