“The major fortunes in America have been made in land.” ~ John D. Rockefeller

If one of the richest men in the American history sees real estate as an opportunity, chances are that you will too. Real estate has proven to be one of the consistent favorites of wealthy men throughout the history, let it be Andrew Carnegie or Warren Buffett. The Oracle of Omaha, Mr. Buffett even went on to say, “If I had a way of buying a couple hundred thousand single-family homes, I’ll load up on them.”

If you’re a real estate investor, you may already agree with these financial behemoths. Real estate offers its own set of benefits starting with consistent returns, hedge from stock market risks, and a sense of ownership.

Considering the advantages of real estate as an investment, why not add it to your retirement portfolio?

Wait, is that even legal?

As a matter of fact, it is absolutely legal. The IRS allows you to invest in real estate through qualified retirement plans. There are several alternative investments that you can choose for your retirement plan including mortgage notes, tax deed/liens, precious metals, private lending, private equity, and joint ventures along with the traditional stock or bond investments.

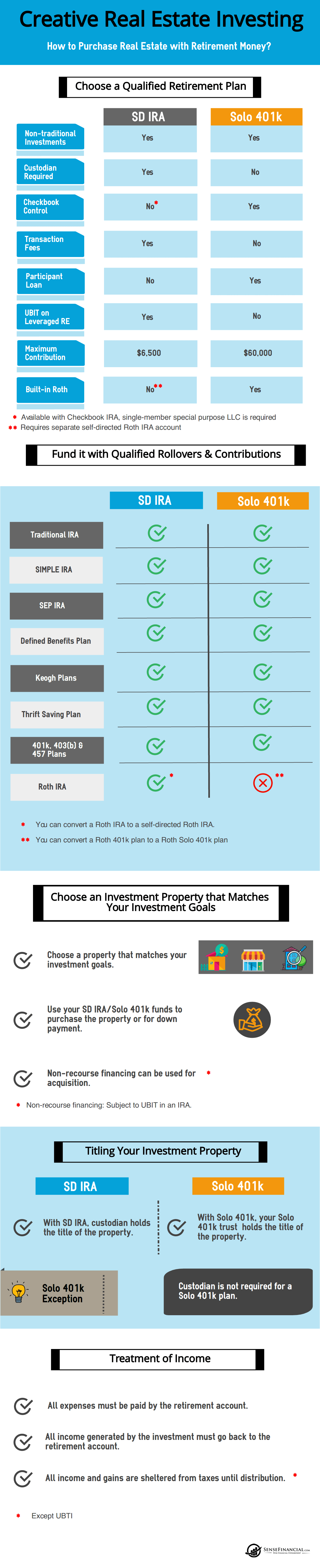

SD IRA and Self-directed Solo 401k Plans Allow Real Estate Investments

Self-directed IRAs are among one of the most popular options for adding real estate to a retirement portfolio. Anyone can open an SD IRA and start investing.

A self-directed Solo 401k caters to a different group of audience. You are eligible to open a Solo 401k only if you are an owner-only business or have active self-employment activity going on. It can be either part-time or full-time self-employment.

Here is an Infographic discussing the investment process

- Open a self-directed retirement account: Start by opening a self-directed retirement plan. Once the plan is active, fund it with qualified rollovers.

- Select your choice of investment: You can invest in a residential or commercial property using your SD IRA or Solo 401k plan. However, if you rather plan on creating passive income, investing in mortgage notes or tax liens/deeds could be an interesting strategy.

- Purchase your property with the plan: Once you have the right property in sight, purchase it with your retirement plan. In case of an SD IRA, your custodian will hold the title of the property. On the other hand, if you purchase the property with a self-directed Solo 401k, your Solo 401k trust will hold the title of the property. The IRS allows the use of non-recourse financing under a self-directed Solo 401k plan.

- How to treat property income: It is critical that the income generated by these properties should flow back to the plan itself. Further, any expenses incurred in the upkeep of these properties should go out the plan alone. The rental income and property returns grow tax-deferred within your retirement plan. You can make qualified withdrawals after paying the due taxes.

Be careful when choosing your investment properties and always ensure positive cash flow. At any moment, avoid prohibited transactions within your self-directed retirement plans.

It’s your retirement portfolio. Start investing in assets that you understand and control.

Tell us what you think in the comment section!

We love your feedback and welcome your comments.

Please post below: