A huge mistake many real estate investment sponsors and investors make when renovating a property is to over spend on upgrading and improving an asset with excessive CAPEX expenses on your commercial real estate investment. Do you have a formula or guideline to make sure your CAPEX costs are not being wasted?

A huge mistake many real estate investment sponsors and investors make when renovating a property is to over spend on upgrading and improving an asset with excessive CAPEX expenses on your commercial real estate investment. Do you have a formula or guideline to make sure your CAPEX costs are not being wasted?

Last week, a leading syndicator asked for my help to raise roughly $7 million of equity for an off market value add multifamily deal. I said, “Sure, let's see what you have. Send me your underwriting model and I'll take a look at the opportunity.”

When I got the model, I quickly looked at the value add component. This syndicator was planning on spending $6,400 per unit of interior and exterior CAPEX renovations to the property. The renovation would take less than one year. As a result of the upgraded property, the syndicator was expecting to get $60/month of increased rents. As I dug into the numbers, I found that the underwriting model assumed a3% rent increase for each year following the acquisition.

So, the model assumed the average monthly rents were going to normally rise along with the market by 3%.Currently, the property average monthly rents are $900. So, in this scenario, in year 2, the average monthly rents would increase from $900 to $927($900 x 3%). That's a $27/month increase in rents come year 2.

The syndicator is projecting a $60/month rent increase from the $6,400/unit renovation. If the property isn't renovated, the rents still increase along with the market at 3% or $27/month. So, is this underwriting model scenario over spending on CAPEX renovations? Could the syndicator spend less on capital improvements and still achieve the desired rent increases?

In this scenario, the $6,400 per unit in CAPEX is going to generate a net rent increase of $33/month ($60-$27). He's going to spend $6,400/unit to get$33/month more in rent. If you do the math, it will take over 16 years to payback the unit renovations ($33/month x 12 = $396/year divided by $6,400).

In this scenario, the $6,400 per unit in CAPEX is going to generate a net rent increase of $33/month ($60-$27). He's going to spend $6,400/unit to get$33/month more in rent. If you do the math, it will take over 16 years to payback the unit renovations ($33/month x 12 = $396/year divided by $6,400).

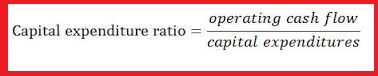

So, I ask you, is this syndicator spending too much on CAPEX? You say, “Well yeah Craig, it looks like it but how do you know?” Ok! Here's the formula and guideline to use when assessing how much of a load your CAPEX renovations should pull….affecting rents, which affect value.

That's a generalization, but it will give you a guideline when measuring and modeling your CAPEX budgets. My message to you: Know the financial impact of the capital improvements that you add to a property. Don't improve a property without knowing the financial benefit those CAPEX expenses will generate for you. The industry standard is that your CAPEX should pay for itself in 5 years or less.

Every time you underwrite a property to buy that requires renovations, whether it is an office building, retail center, self storage building, or whatever, ask your-self this question, “What financial benefit am I going to get as a result of the CAPEX expenses I have modeled?” What load is the CAPEX pulling? Have an answer to that question and you will not overspend on your CAPEX renovations. You'll find the right balance between CAPEX and rent increases. I hope this tip serves you. I look forward to helping you reach for the stars!

Every time you underwrite a property to buy that requires renovations, whether it is an office building, retail center, self storage building, or whatever, ask your-self this question, “What financial benefit am I going to get as a result of the CAPEX expenses I have modeled?” What load is the CAPEX pulling? Have an answer to that question and you will not overspend on your CAPEX renovations. You'll find the right balance between CAPEX and rent increases. I hope this tip serves you. I look forward to helping you reach for the stars!

We love your feedback and welcome your comments.

Please post below: