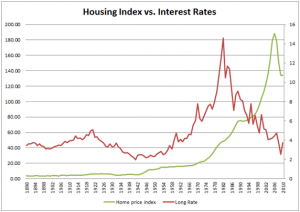

Conventional wisdom maintains that home prices and mortgage rates go hand-in-hand—rates go lower means mortgages are cheaper and there’s higher demand for housing. At first glance this makes perfect sense, but how have real estate prices behaved in the past with respect to mortgage rates?

History tells a comforting story: The world doesn’t end when rates go higher:

For those of you with bad memories of stats class, please forgive me, but eye-balling a chart doesn’t give the full story. I’ll spare you the regression tables, but suffice it to say that there is a long term positive relationship between interest rates and real estate prices! You can see regression results here if you want the details.

Either interest rates matter less than other factors in driving home prices, and the correlation is merely coincidence; or, higher rates occur under conditions that favor housing. Here’s what I mean: There’s so many factors that can affect housing (personal income, general economic conditions, supply vs. demand, family formation, population growth, technological innovations like the automobile that enabled suburbia, etc.) that interest rate consequences can easily be lost in the mix.

If all of the many other factors were held constant, we would probably see a negative relationship to validate conventional wisdom.

One interesting question we should ask is: Can high interest rates actually benefit real estate? One thing that’s for certain is that high interest rates provide incentive to save. More savings means healthier consumer balance sheets, better credit, and more equity to put down on a home. So higher rates should improve the conditions necessary to buy at some point in time.

Things Are Different This Time. Those are five of the scariest words in finance! But one thing to consider is that the last housing boom was undertaken during a period of rapid credit expansion. So even though history doesn’t show us a clear negative correlation between rates and housing prices, we might surmise that the credit cycle may need to contract to reach a stable footing. If the current mix of home prices and savings levels require buyers to rely on mortgage debt that they might not be able to afford at higher rates, then we may finally see conventional wisdom meet reality.

We love your feedback and welcome your comments.

Please post below: