Ask a novice Landlord about Cash Flow and they'll just subtract the mortgage payment from the rent (hopefully they’ll at least include taxes and insurance). If they’re a little sharper, they’ll build in the cost of vacancies and marketing. With more experience, they’ll start factoring in basic maintenance and accounting costs.

Ask a novice Landlord about Cash Flow and they'll just subtract the mortgage payment from the rent (hopefully they’ll at least include taxes and insurance). If they’re a little sharper, they’ll build in the cost of vacancies and marketing. With more experience, they’ll start factoring in basic maintenance and accounting costs.

But that’s still a recipe for failure…..

When the roof starts springing leaks in a half dozen places, most landlords are shocked at the sudden $5,000 bill for a new roof. They reassure themselves (and their spouses) with lines like “This was a one-time setback, I won’t have another bill like this for twenty years.” Eight months later the furnace breaks down and costs $2,000. Next year when the tenants leave, the landlord is surprised when they realize they can’t put off updating the old-school bathroom anymore, if they want to attract decent tenants.

Landlording & CapEx

Anyone who wants to consistently make a profit as a Landlord and Rental Property Investor needs to understand CapEx, or capital expenditures. These are infrequent, but recurring, large expenses that are unavoidable in real estate.

Roofs, air conditioning condensers, furnaces, windows, kitchens, bathrooms, plumbing, wiring, basement waterproofing, siding, mortar, foundations, driveways, appliances. Everything gets old and eventually needs to be replaced, and long-term rental investors need to factor these costs into their cash flowbefore buying.

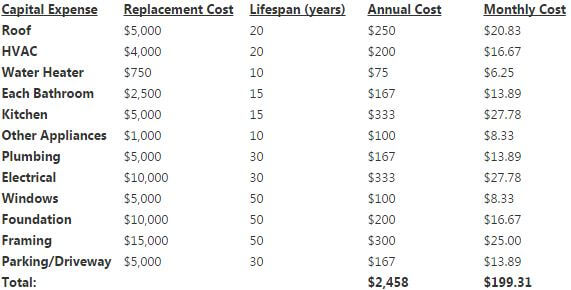

Let’s look at some sample math. Emphasis on sample – these are made-up numbers that will vary from property to property:

Note that this list does not include maintenance that should be done between most tenancies: painting, new flooring, landscaping, pest treatments, etc. Also bear in mind that apartment buildings have two sets of costs to calculate: overall building and grounds costs (e.g. the roof), and per-unit costs (e.g. kitchen updates).

Buying Long Term Investment Property

You need to account for all of these costs before buying a long-term rental investment property. Part of the evaluation process needs to include finding out as much as you can about when each system was last replaced. Obtain copies of invoices and receipts if possible. Even though the monthly CapEx projection will be the same regardless of whether the roof was replaced last month or twenty years ago, you'll have a better sense of when these bills will come due. Out of necessity, you'll need more money held in a cash reserve in order to responsibly buy a rental property with many aging components.

Here are the expenses your cash flow projections should include, when evaluating a potential investment (along with sample numbers):

Don’t like what you see after doing the math? Move on to the next property. Or invest in a REIT as an altenative real estate investment. But every brick-and-mortar real property that you buy must have CapEx budgeted into the monthly cash flow, so you're not surprised when major repairs rear their ugly head.

As a final note, consider that your capital expenditures will be a much higher percentage of the rent for lower-end properties. Yes, CapEx will be a little higher for larger, higher-end homes, but costs don't rise proportionately to home prices. For a low-end house that rents for $700, having to budget $200/month for CapEx can be a dealbreaker. For a house that rents for $2,000, budgeting $230/month for CapEx is proportionately a much lower cost. It really is harder to make money on lower-end rental properties.

Accurately estimating and budgeting for capital expenditures is the difference between buying winning rental properties and buying a money pit. CapEx is the silent killer of most new landlords, and why so many flee the industry after their first rental property goes south.

Accurately estimating and budgeting for capital expenditures is the difference between buying winning rental properties and buying a money pit. CapEx is the silent killer of most new landlords, and why so many flee the industry after their first rental property goes south.

(Free resource: see REIClub's 30- Landlording & Rental Properties Videos to learn more about rental properties.)

We love your feedback and welcome your comments.

Please post below: