The financial world today in 2016 is unlike any other period of time in global history. We’ve seen wide-ranging price fluctuations since 2007 in all sorts of investment options such as real estate, stocks, bonds, oil, gold, silver, and other assets.

The financial world today in 2016 is unlike any other period of time in global history. We’ve seen wide-ranging price fluctuations since 2007 in all sorts of investment options such as real estate, stocks, bonds, oil, gold, silver, and other assets.

Interest rates have fallen near all-time lows in U.S. history while bond debt has reached record highs. Many “positive” (0.1% to 0.5%) bank savings rates have actually reached the equivalent of negative net returns once factoring in taxes, bank fees, and the hidden impacts of inflation on our money. Yet, more banks and the Federal Reserve are openly discussing the very real possibility of offering negative interest rates to the general public just as seen in many parts of Europe and Japan.

Dow Jones’ Wild Roller Coaster Ride

One prime example of extreme value changes has been the Dow Jones stock index which once reached lows in March 2009 near 6,500 prior to later reaching an all-time high closing at 18,312.39 on May 19, 2015. So, the Dow increased from market closing lows to highs almost 12,000 points over the span of just over six years.

This massive increase in Dow Jones prices has been alleged to be partly as a result of artificially manipulated price strategies used by High Frequency Traders and Quantitative Easing (Federal Reserve creates money out of thin air in order to push up asset prices for stocks, bonds, and mortgages) rather than solid financial and economic data numbers.

A relatively small percentage of Americans actually own stock in any of the 30 core companies which make up the Dow Jones index. Some of the primary companies listed in the Dow Jones index include Apple, Boeing, Chevron, Disney, Exxon Mobil, General Electric, Goldman Sachs, IBM, Johnson & Johnson, Procter & Gamble, Visa, and Wal-Mart.

Interestingly, some of the biggest buyers of these Dow Jones companies were not other new investors. Rather, they were the same companies buying back their own stock to hopefully boost their own stock prices. Many people keep their eyes focused on the daily direction of the Dow Jones in order to try to gain a sense of whether or not the economy is booming or busting in spite of whether or not they own any of these Dow 30 companies themselves.

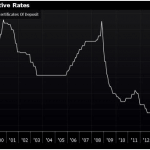

Interest Rates’ Wild Swings

In December 1980, the U.S. Prime Rate reached a mind-boggling 21.5%. In early 2016, the same U.S. Prime Rate has firmly sat in place at 3.5%. This same 3.5% Prime Rate seems incredibly expensive when compared with the Federal Discount Rate at 1 %, the Fed Funds Rate at 0.5%, and the 11th District Cost of Funds rate hovering near 0.655% (as of 2/3/16).

Countries around the world have pushed ZIRP (Zero Interest Rate Policy) and NIRP (Negative Interest Rate Policy) strategies in recent years in order to attempt to better stabilize their financial markets. As a result, we’ve seen investment options in 2016 and 2015 which offered yields of between – 1% (negative) and 20.9% + for high yield junk bonds offered by various financial institutions and energy companies (pricing: 2/9/2016 – https://research.stlouisfed.org/fred2/series/BAMLH0A3HYCEY ). By adding up the two of the biggest yield extremes available today to investors, the combined return is not too far off from the peak Prime Rate highs near 21.5% back in late 1980 and early 1981.

Bloomberg reported on February 9, 2016 that upwards of $7 trillion in government bonds available for purchase across the world were offering negative returns. Here is a short excerpt from that article:

“More than $7 trillion of government bonds offered yields below zero globally as of Monday. The total is poised to swell further after Japan’s 10-year yield went below zero for the first time on record on Tuesday. A negative yield means investors who buy the debt now and hold to maturity will receive less than they paid.”

(Source above: http://www.bloomberg.com/news/articles/2016-02-09/world-s-negative-yielding-bond-pile-tops-7-trillion-chart )

Dunkin’ Danish Rates

Many times, financial trends which first begin in Europe or Asia later eventually hit the shores of the U.S. One country of interest to me over the past several years is the country of Denmark. Over the past year or so, the Danish Central Bank (“The Nationalbank”) slashed their interest rates below zero percent. As of February 2015, The Nationalbank’s key benchmark rate reached a low of -0.75% (negative .75%) after four previous rate cuts.

Parallel to these Danish rate cuts, the one-year mortgage bonds were yielding and trading somewhere between -0.3% and -0.4%. Last year, the Swiss National Bank also has cut their key benchmark rates in the floating range between -0.25% and -0.75%.

Things have gotten so dysfunctional over there in parts of Europe that one or more banks in Denmark began offering their best customers mortgage loans with negative rates. Yes, banks will beg you to borrow money from them to buy a home while paying you to use their money at the same time.

NIRP and Real Estate Price Booms

The Federal Reserve has openly talked about going to a NIRP (Negative Interest Rate Policy) strategy in America, so we may want to begin to think about this potential impact on real estate. Denmark has already been pushing negative rates since mid-2012. To better understand how NIRP strategies in the U.S. could potentially impact real estate positively or negatively, let’s review what has happened to property values in Denmark since they began using negative rate policies a few years ago.

The Federal Reserve has openly talked about going to a NIRP (Negative Interest Rate Policy) strategy in America, so we may want to begin to think about this potential impact on real estate. Denmark has already been pushing negative rates since mid-2012. To better understand how NIRP strategies in the U.S. could potentially impact real estate positively or negatively, let’s review what has happened to property values in Denmark since they began using negative rate policies a few years ago.

With Danish borrowers either paying zero rates for mortgages or actually getting paid by their own lenders to borrow money, the property prices in Copenhagen, the capital of Denmark, have skyrocketed 40% to 60% since mid-2012.

Negative rates can scare people out of wildly swinging stock and bond markets back into real estate which seems more stable at this point, or they can pull their funds out of banks which offer negative returns under the threat of bank bail-ins should these same financial institutions later default on their own debt. As such, negative rates can create incredibly positive real estate returns for investors who find the best discounted deals out there with the cheapest money sources.

We love your feedback and welcome your comments.

Please post below: