To get straight to the point, once you find a commercial deal to evaluate, you’ll need to find the answer to this all-important question rather quickly: How Much is the Cash Flow?

When you are a new commercial real estate investor, you should familiarize yourself with quickie and easy ways to calculate the cash flow of a potential multi-family or apartment deal.

In evaluating any commercial deal (or any income-producing property), there are 3 Steps to figure out Cash Flow: 3 Steps to Cash Flow

- Step 1: Get the Income per year

- Step 2: Get the Expenses per year

- Step 3: Get the Debt service per year

This is all you need to initially evaluate any commercial deal!!! After you do this, all that’s left is simple subtraction:

Step 1 Amount (minus) Step 2 Amount (minus) Step 3 Amount = Cash Flow per year

Income – Expenses – Debt Service = Cash Flow per year

Step 1 – Annual Income

Investors you will need to find out what the total rents are per month. Add it all up and then get the yearly amount by multiplying by 12.

Step 2 – Annual Expenses

Step 2 is to find out what the operating expenses are on a monthly basis. The operating expenses do not include mortgage principal or interest, but do include typical items such as taxes, insurance, utilities, repairs and maintenance, property management fee, salaries, landscaping, administrative costs, advertising, and supplies.

Step 3 – Annual Debt

Step 3 is to find out what the monthly mortgage would be if you bought the property and then multiply that amount by 12 to get an annual mortgage amount.

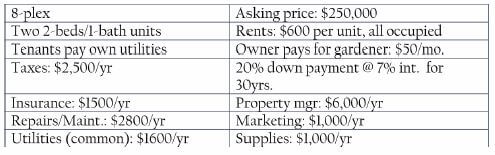

Let’s do a quick ‘n easy deal evaluation: 8 unit apartment building

Step 1: The income is $600 per month per unit x 8 units = $4,800 per month total x 12 months = $57,600 per year. Therefore, income is $57,600 total per year.

Step 2: The expenses total up to = $17,000 total per year.

Step 3: The debt service is:

- Figure out the principle: $250,000 – 20% down payment: $250000 – $50,000 = $200,000

- Figure out the monthly payment on the principle at a 7% interest rate with 30-year amortization. Using an online mortgage calculator, the payments come out to be $1331 per month.

- The debt service is $1331 x 12 months = $15,972 per year.

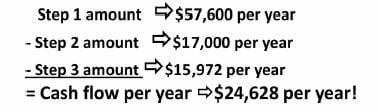

Now, you have all three things you need to calculate the cash flow.

Therefore the cash flow is: $24,628

Was that too difficult?

What you just did can be used for any type of income-producing real estate – office, shopping center, apartments, self-storage, mobile home park, etc.

We love your feedback and welcome your comments.

Please post below: