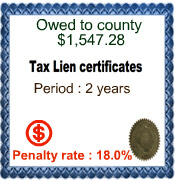

What is a tax lien? Tax liens occur when a property owner has not paid local taxes on a property. The local government will issue a lien against the property that states that it can't be sold and ownership cannot be transferred until the owed amount has been paid in full. It will look something like the image to the left. A “certificate” or certified municipal form or document is issued that details the legal description of the property, owners name, the taxing district, the yield or return, and the principal of delinquent amount of taxes.How do you make money on someone else's tax lien? It's called a tax lien sale. An auction is held by the public authority who sells the property in order to settle the tax lien. The winning bidder is purchasing the right to own the property if the original property owner doesn't repay the tax debt to the winning bidder.

What is a tax lien? Tax liens occur when a property owner has not paid local taxes on a property. The local government will issue a lien against the property that states that it can't be sold and ownership cannot be transferred until the owed amount has been paid in full. It will look something like the image to the left. A “certificate” or certified municipal form or document is issued that details the legal description of the property, owners name, the taxing district, the yield or return, and the principal of delinquent amount of taxes.How do you make money on someone else's tax lien? It's called a tax lien sale. An auction is held by the public authority who sells the property in order to settle the tax lien. The winning bidder is purchasing the right to own the property if the original property owner doesn't repay the tax debt to the winning bidder.

Tax Lien Investing 101

Different Type Of Property Liens There are 3 kinds of liens that may be placed on property:1. Judicial liens (also called “judgments”): Come from lawsuits by a creditor.2. Statutory liens: Typically tax liens, either from the IRS, state taxes, and property tax.3. Consensual lien: Missed mortgage payments. What is the Tax Lien Process? First, the home owner does not pay their local property taxes. So the local government makes a lien against the property, which prohibits the sale or transfer of the property until the tax debt is paid in full. After that the local government offers a tax lien at auction to cover the unpaid taxes.You attend the auction and bid. Be sure to research before bidding; thoroughly inspect the property and do a lien and title search. The lowest interest bid or most favorable fixed interest goes to the highest bidder. Next, you’ll have to wait and see. If the property owners don’t pay the lien, action is taken. In some states, the owner of the tax lien certificate needs to apply for, and then gets, the property deed. In others, there is an auction for the property. You bid on the unpaid lien plus the interest due to you as the certificate owner.In some states, the investor can bid MORE than the actual amount of the lien, which brings the effective interest rate down. In other states, the process is done by a lottery system, which means you get the statutory rate.As with any investment, do your research and due diligence on the properties you are bidding on. You are investing in tax liens for a return on investment, not to get the property. Most often, if you end up with a property, its one you don't want! Treat This as a Business People are lured to real estate because of the quick buck that it promises. Don't hold your breath, you won’t get rich quick. An “overnight sensation” usually takes about five years. I would guess that 90% of the people who take a seminar quit after three months. This is a business like any other. It takes months, even years to cultivate customers and have a life of its own. You need to treat it like any other business. Give it time, effort, attention and professionalism, and it will flourish before you know it.

We love your feedback and welcome your comments.

Please post below: