Whether you know it or not, private money lenders are all around us. Anyone with money to spare and the slightest bit of curiosity – for that matter – may be considered a viable candidate to go into business with. It is up to you, however, to learn how to flush them out in a way that is conducive to developing a working rapport.

Whether you know it or not, private money lenders are all around us. Anyone with money to spare and the slightest bit of curiosity – for that matter – may be considered a viable candidate to go into business with. It is up to you, however, to learn how to flush them out in a way that is conducive to developing a working rapport.

As I am sure you are aware, leveraging other people’s money is one of the most valuable assets real estate investors have. Do yourself a favor and take the appropriate steps towards working with private money lenders; I can assure you that you will be glad you did.

That said — just because someone has the money, it doesn’t mean they are going to invest it in every opportunity that comes their way. You must convince them that they would be foolish not to invest in your talents. Provide them with a reason to want to work with you. Done correctly, leveraging the money of private investors can easily become the backbone of your entire business.

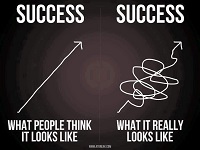

If my years as a real estate investor have taught me one thing — it’s that anything is possible. At the risk of sounding cliché, you really can accomplish anything you put your mind to. I like to think of this concept as the entrepreneurial mindset. Not everyone is born with it, but it is entirely possible to learn it, and implement it. It is, for all intents and purpose, how I tackle my most pressing problems. And not unlike most new real estate investors, I had a problem finding private money lenders when I first started out in the business. Fortunately, there is no need for you to struggle as I did. Take it from me; finding private money lenders is as easy as:

Finding Private Money Lenders

1. Writing A Letter:

Take a minute to consider all of the people you know. Whether or not you are tapped into the real estate industry shouldn’t make a difference, but carefully compile a list of those people you think would have at least some degree of interest in real estate investing. I recommend starting with those that are closest to you, and working out from there. Even if you aren’t sure of their interest level, go ahead and put their name down.

Next, I want you to physically type a letter that will be mailed to the list you just created. Identify what it is you do in the industry, and let people know you are looking for potential investors. There is no need to be shy or to beat around the bush; go ahead and explain that you may require funding for a few deals down the road, and that any help wouldn’t go unrewarded. However, the letter should be more of an introduction into the business, as to get a feel of whether or not they are interested.

2. Prepare For Incoming Calls:

Prior to sending any letters out, be sure that you can accommodate the influx of incoming calls that may result from your efforts. I can assure you that you will want to be able to handle the calls coming in; otherwise you just wasted your efforts. That said – every missed call is a missed opportunity.

You will want to be prepared for the volume of calls, but also the questions that will inevitably come with them. Don’t be surprised if everyone has questions; just be sure to have answers. The last thing you want to do is pause and struggle to find an answer to a simple question, especially when money is on the line. You must come off confident and professional. Your goal, not unlike the letter, will be to introduce them to what it is you do. I also can’t stress enough how important it is to get their contact information. However, your ultimate goal is to set up a meeting with those that call you back. Remember, if they call inquiring about your letter, there is at least some degree of interest at play.

3. Follow Up:

No longer than a week after your conversation, send a follow up email. If you don’t have their email, a call is your best bet. I actually recommend following up with whichever medium they used to contact you initially. Chances are it is what they prefer.

Your follow up should explain what a private money lender is, and how you can potentially partner up on a future deal. You should also set up a meeting, if you haven’t done so already. Make the date specific, as it will be easier for them to remember and commit to.

4. Meet:

You will be surprised by the results of such a simple campaign. I have seen best friends partner up when their interests and goals align properly. But no matter who you schedule a meeting with, you need to treat them like they are the most important person to your business, because guess what? They are.

Before you meet, you should have an idea about how you find deals, how returns work, expectations, and – most importantly – numbers. Any investor wants to feel that their money is in good hands, but you must inform them that there is an inherent degree of risk involved. Don’t be afraid to explain the potential returns and timeframes either. You should type up a brief explanation of how you work, and some answers to frequently asked questions. Hand this to them when you are done, and set up a subsequent meeting.

5. Commitment:

From the time of your meeting until you finalize your first deal, you should prepare yourself to answer any questions that come your way. You may even have to meet with people a few more times, if for nothing else than to put them at ease.

From the time of your meeting until you finalize your first deal, you should prepare yourself to answer any questions that come your way. You may even have to meet with people a few more times, if for nothing else than to put them at ease.

Spend your time on the people that seem genuinely interested, but don’t forget to respond to new emails. Your goals are to have as many different financing options as possible. Real estate is a numbers game, the more lending options you have, the better.

We love your feedback and welcome your comments.

Please post below: